Ethereum (ETH) Price Prediction And Analysis In October 2019

08 Oct 2019

As the second most popular coin on the market, Ethereum’s ETH token is still an attractive investment opportunity. We will be looking into the factors that can help us come to an Ethereum price prediction for October 2019.

What Is Ethereum (ETH)?

Ethereum was created by Vitalik Buterin at the end of 2013, with the network being officially launched on July 30, 2015.

Ethereum was created by Vitalik Buterin at the end of 2013, with the network being officially launched on July 30, 2015.

The Ethereum open-source blockchain allows developers to create and deploy distributed applications (DApps) and smart contracts. The token which powers this network is called Ether (ETH) or Ethereum, but it should be noted that there is a distinction between the Ethereum token and the Ethereum network.

Ethereum consists of multiple programming languages to allow for more development flexibility, but they also created their own language called Solidity.

Ethereum (ETH) Price Analysis

On September 30th, ETH was trading at $170, closing the day at $177. October 1st saw Ethereum gaining momentum, reaching $184 in the morning, but slowly started going back down to the day’s starting value at $177 when the day ended. October 2nd reached the $180 once during the day, but it failed to maintain this price, fluctuating at $177-$178 until the day ended.

Ethereum is currently trading (October 4th) at $175.21, down 1.26% for the day, with a market cap of $18,923,804,694. The highest value recorded over the past 7 days is $185.05, with the lowest being $163.21.

For our Ethereum price prediction, we will be analyzing the performance of both ETH/USD and ETH/BTC pairs.

Ethereum is moving slowly above resistance levels and trying to gain momentum, so we can notice that the ETH/USD pair is breaking from the trendline the 6th of August’s top hit. If the pair closes a bit higher than this trendline, which has an EMA50 ($176.38), it can suggest that the ETH/USD is might expect growing tendencies.

If EMA50 can be surpassed, ETH might rise to a price of $185 or EMA100. Once this level is reached, it can continue to further reach the $195 and $205 price range. As Bitcoin (BTC/USD) has already moved past the EMA10, we expect Ethereum (ETH/USD) to soon copy this movement, pass over the resistance level, and reach higher prices. The MACD is also showing a bullish deviation.

Since the Descending Triangle 2 broke the bottom line two weeks ago, ETH has attempted to climb back to the bottom break region. As there were two rejections by now, it clearly warns of a bear tendency with an upward tilted channel.

The bullish movement will have to break the $185 level and go higher, so that it can negate the bear flag on the Daily. As a result, we can expect Ethereum to dip in the following days, reaching even levels around $150 price.

The charts show that the ETH/BTC pair has been on a downward trend for the past year. But the price has shown lately positive movements distancing itself from previous support levels of 0.0155-0.0160 BTC, that were the all-time low.

The price currently trades in the midline of the descending channel, which is along with the 157 moving average. 0.025-0.026 BTC is an important resistance level, which, if broken, can indicate a return to the zone 0.0308-0.0309 and the start of a new uptrend.

Developments and Updates

An Ethereum price prediction is not complete without taking into account the developments, updates, and projects which implicate the token.

Ethereum has many projects announced with Fortune 500 companies that involved building applications (or dApps, decentralized apps) on the Ethereum blockchain. To power all these dapps or smart contracts, Ether (ETH) is needed. An increase in usage could contribute to a price increase.

As more apps are developed, one would expect the coin supply to get scarcer. While Ether is currently not capped, an infinite amount of coins can be created. But should demand for ETH see an increase, so should the price.

Ethereum developers have launched an update of the network on September 30th. The Istanbul system-wide upgrade led to the fork of the Ropsten test network into two separate chains following the activation of system-wide upgrade Istanbul.

According to the Ethereum Foundation community manager, Hudson Jameson, the forked occurred because of unusually fast block confirmation times.

He went on to explain that the majority of miners on the Ropsten blockchain did not upgrade to the latest software, catching many of developers off guard. This is probably because the update was initially postponed from September 2nd and announced on October 2nd, but it seems that the Ethereum developers went for an early release.

A big Ethereum event, the Devcon5 conference is scheduled to take place in Osaka on the 8th of October.

Ethereum (ETH) Price Prediction: Market Opinion for October 2019

We have also included some of the most popular Ethereum price predictions for the month of October made by crypto sites.

News.u.today

News.u.today bases its Ethereum price prediction on analytical data.

They noticed the ETH price is “forming a continuation pattern to the upside,” and they expect the ETH price to be around $200 in October.

Crypto-rating

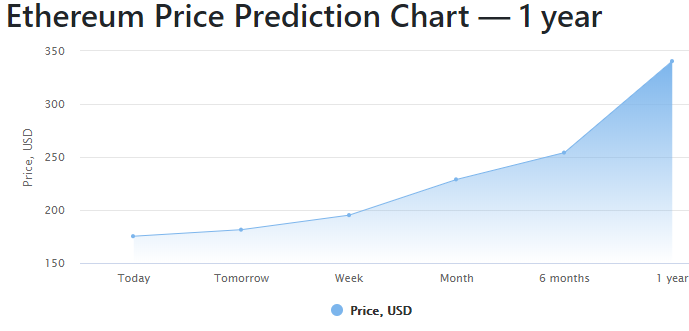

Crypto-rating’s Ethereum price prediction is based on an algorithm which is based on historical data, forecasting that the Ethereum price will be at $195.15 in 1 week and $228.89 in 1 month.

Pundf.co

The Poundf.co website releases price predictions for every day of the month, with the highest and lowest values of each particular day.

- October, 7: price 168.342 Pounds, high 180.620, low 156.018;

- October, 8: price 171.989 Pounds, high 184.273, low 159.704;

- October, 9: price 167.075 Pounds, high 146, low 126;

- October, 10: price 178.112 Pounds, high 190.420, low 165.877;

- October, 11: price 174.427 Pounds, high 186.766, low 132;

- October, 14: price 174.427 Pounds, high 186.766, low 132;

- October, 15: price 185.476 Pounds, high 199.019, low 171.991;

- October, 16: price 180.563 Pounds, high 192.877, low 168.307;

- October, 17: price 185.476 Pounds, high 199.019, low 171.991;

- October, 18: price 155.997 Pounds, high 167.078, low 144.940;

- October, 21: price 147.399 Pounds, high 157.223, low 137.570;

- October, 22: price 144.933 Pounds, high 154.767, low 135.127;

- October, 23: price 142.477 Pounds, high 152.310, low 132.670;

- October, 24: price 141.248 Pounds, high 151.096, low 131.442;

- October, 25: price 146.161 Pounds, high 156.010, low 136.355;

- October, 28: price 147.390 Pounds, high 157.239, low 137.570;

- October, 29: price 154.759 Pounds, high 165.877, low 143.760;

- October, 30: price 160.935 Pounds, high 171.991, low 149.904.

According to their Ethereum price prediction, the coins should end the month at a price of 160.935 Pounds, with a maximum of 171.991, and a minimum of 149.904.

30rates

30rates also posts a table of the daily possible prices for a variety of coins, including ETH. In addition to the highest and lowest values, they also include the closing price for each day.

- October, 7: minimum price $157, maximum $181, with a closing price of 169;

- October, 8: minimum price $161, maximum $185 with a closing price of 173;

- October, 9: minimum price $156, maximum $180 with a closing price of 168;

- October, 10: minimum price $167, maximum $193 with a closing price of 180;

- October, 11: minimum price $163, maximum $187 with a closing price of 175;

- October, 14: minimum price $163, maximum $187 with a closing price of 175;

- October, 15: minimum price $171, maximum $197 with a closing price of 184;

- October, 16: minimum price $167, maximum $193 with a closing price of 180;

- October, 17: minimum price $171, maximum $197 with a closing price of 184;

- October, 18: minimum price $144, maximum $166 with a closing price of 155;

- October, 21: minimum price $137, maximum $157 with a closing price of 147;

- October, 22: minimum price $134, maximum $154 with a closing price of 144;

- October, 23: minimum price $132, maximum $152 with a closing price of 142;

- October, 24: minimum price $130, maximum $150 with a closing price of 140;

- October, 25: minimum price $137, maximum $157 with a closing price of 147;

- October, 28: minimum price $139, maximum $159 with a closing price of 149;

- October, 29: minimum price $146, maximum $168 with a closing price of 157;

- October, 30: minimum price $153, maximum $175 with a closing price of 164.

Their Ethereum price prediction for October 31, sees ETH having a minimum price of $153, a maximum of $177, closing the day at $165.

Ethereum Price Prediction: Conclusion

There is no way of knowing what price will Ethereum reach in the future, but with some market information and analysis, you can form a general idea on which you can base your trading strategy.

Featured image: coinstaker.com

Source From : Coindoo NewsRelated News

© CoinJoker 2019 | All Rights Reserved.